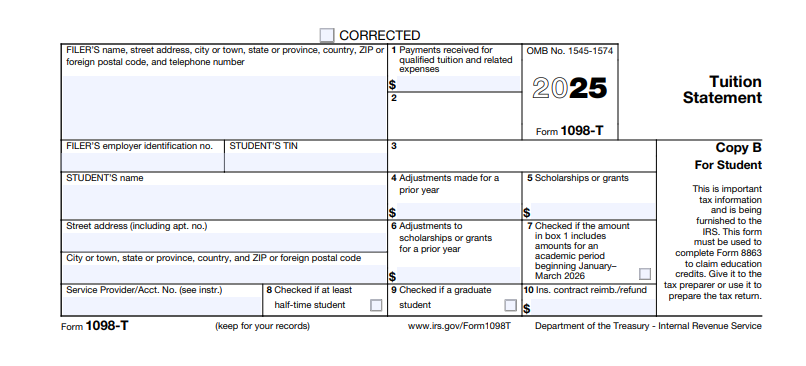

The Form 1098-T reports payments applied to qualified tuition and related expenses during the calendar year for which they receive academic credit. The information reported on Form 1098-T helps students evaluate their eligibility for certain federal tax benefits.

In accordance with the Internal Revenue Service requirements, FIU reports amounts paid during the calendar year for qualified tuition and related fees. The amounts reported on Form 1098-T may differ from the amounts relevant for claiming any tax benefits.

For information regarding filing your tax return, tax benefits for education and tax credits or deductions relating to your Form 1098-T please consult a tax professional. FIU cannot provide individual tax advice.

Other useful information, including IRS Publication 970 –Tax Benefits for Education, can be accessed at IRS website or by calling the IRS at 1-800-829-1040.

1098-T Form Important Information

Make sure that your SSN or ITIN number is updated on your record.

According to IRS guidelines, a 1098-T statement will not be provided to non-resident aliens, international students, or where qualified tuition and related expenses were entirely waived.

How to Get the Form

- Log onto MyFIU.

- Click on 'Financial Account' tile.

- Click on 'View 1098-T.'

- Click 'Accept' when the Form 1098-T Electronic Recipient Statement page displays (displays the first time you log on).

- If you click accept, you agree to receive the current and future Forms 1098-T electronically (the message does not display again). If you click decline, you should contact the Student Financials office to request a printed copy of your Form 1098-T (the next time you access the 1098-T Data page the option to accept will display again).

- Click the FIU 1098-T year. Your Form 1098-T Tuition Statement will be displayed. This page displays all the information on the Form 1098-T. From this page, click each box to see more detailed information.

- Click the Print 1098-T button and a replica of the form displays. Use the print function in your web browser to print a copy for your records.